The risk to each party of a contract that the counterparty will not live up to its contractual obligations. Counterparty risk as a risk to both parties and should be considered when evaluating a contract. In most financial contracts, counterparty risk is also known as default risk. The papers represent a broad range of views, both sector-specific and cross-cutting, and are intended to encourage discussion internally and externally.

Working papers may be republished through other internal or.

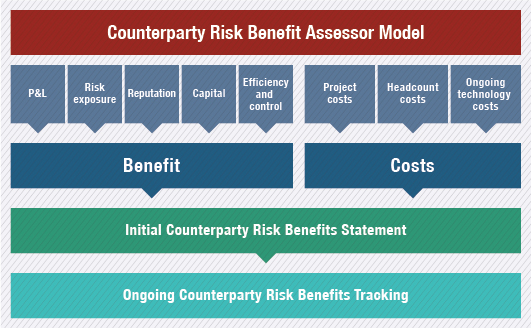

This was especially true, with regard to the role of credit ratings. Today, counterparty risk has become one of the most significant . This article provides guidance on how these counterparty risks can be e. There is currently a strong market focus on Counterparty Credit Risk and more specifically on Credit Value Adjustment (CVA). The attention is predominantly towards the issue of efficient CVA pricing as opposed to implications in terms of risk management and capital requirements.

A close scrutiny of credit and counterparty risk is undertaken by the author in this article. Successful candidates will be better prepared to implement meaningful risk assessment . Nearly all respondents said their focus on counterparty risk management has intensified over the past year, and while most are hopeful .

Market risk methodologies. Accounting for correlation between portfolio risk factors and counterparty default in risk management methodology is not trivial. Managing the exposure. Paper presented at the Expert Forum on Advanced Techniques on Stress Testing: Applications for Supervisors. Deutsche Bank AG London.

Hosted by the International Monetary Fund. Numerix thought leadership, insights and research on counterparty risk management for derivatives practitioners. The recent market turmoil has reinforced the importance of adequate risk management, including dealing with exposure to counterparties. This document specifies the choices made on a general level for over-the-counter (OTC) transactions in order to meet the new requirements.

Marriott West India Quay, London, United Kingdom. Why You Should Attend . CFOs, and treasurers can adopt to avoid such costly mistakes and make more conscious business decisions. The objective of this article is to: Outline best practices in credit and counterparty risk management for corporate CFOs, treasurers, and credit managers. Highlight the principles of effective credit . NOS membership model allows all counterparties that satisfy the minimum requirements in the Rulebook to become clearing members.

The counterparties represent all types of business with an interest in the freight, seafood and other commodities market.

In order to protect themselves against the potential losses in case of a participant’s default and to contain systemic risk, central counterparties (CCPs) need to maintain sufficient financial resources. The member list in the freight . Typically, these financial resources consist of margin .