Der Endowment -Effekt (englisch für Besitztumseffekt) ist eine Hypothese aus der Verhaltensökonomik. Sie besagt, dass Menschen dazu tendieren, ein Gut wertvoller einzuschätzen, wenn sie es besitzen. This is typically illustrated in two ways.

In a valuation paradigm, people will tend to pay more to retain something they own than to obtain something they do not . The Journal of Economic Perspectives, 5(1), pp.

Permission to make digital or hard copies of part or all of American Economic. Association publications for personal or . Samuelson and Zeckhauser . Experimental Tests of the Endowment Effect and the Coase Theorem. University of California, Berkeley.

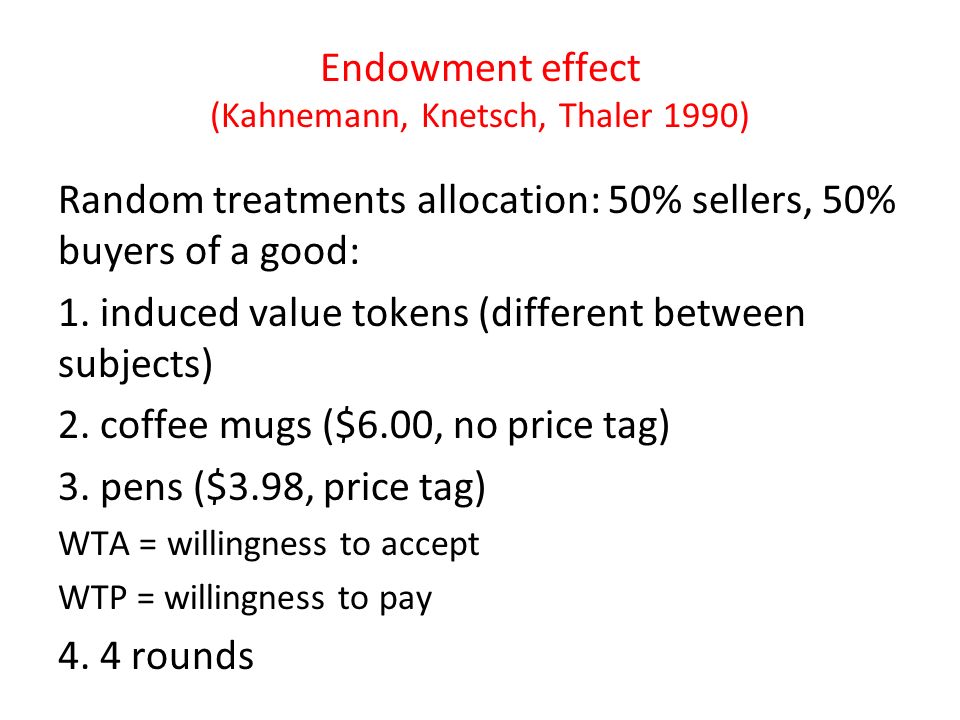

Contrary to theoretical expectations, measures of willingness to ac- cept greatly exceed measures of . It is evident when people become relatively reluctant to part with a good they own for its cash equivalent, or if the amount that people are willing to pay for the good is lower than what they . Effekte in der Unternehmenspraxis aufzuzeigen.

Das als Besitztumseffekt bezeichnete deskriptive Entscheidungsverhalten, im. Englischen Endowment Effect genannt, geht auf Arbeiten von Thaler zurück und stellt ein Phänomen innerhalb der von Kahneman und Tversky entwickelten Prospect. Potential implications and directions for future research are discussed.

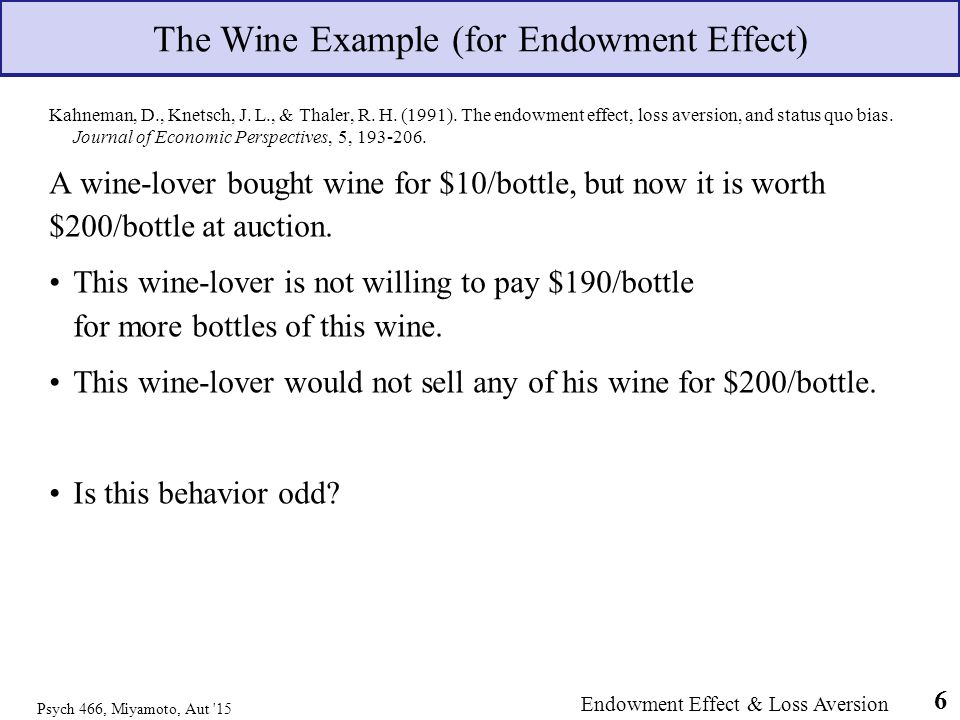

Why the inconsistencies? Both scenarios highlight what Thaler termed the “ endowment effect ,” and it explains our irrational tendency to overvalue something just because we own it. Thaler is perhaps most famous for his work on two kinds of economic irrationality: “mental accounting” and the endowment effect. Both of these explain behaviors that are hard to make sense of through traditional economic theory, but which should be familiar to anyone who has been, like, a human walking . The endowment effect is a hypothesis about behavior. Thaler , Toward a positive theory of consumer choice.

Unfortunately, there is little in the way of formal tests. One recent study by SRI International does provide . Since the goods were randomly distribute neoclassical theory predicts that there should have been much more trading than there actually was. Thus the concept of the “ endowment effect ” was . THE ENDOWMENT EFFECT : EVIDENCE OF LOSSES VALUED MORE THAN GAINS.

The economic theory of the consumer is a combination of positive and normative theories. Since it is based on a rational maximizing model it describes how consumers should choose, but it is alleged to also describe how they do choose.

This paper argues that in certain well-defined situations many consumers act in a. People were each given a coffee mug and then given the choice to sell or swap it for an equally-priced alternative which, in this case, was a pen. Fascinatingly, they found that people wanted to be paid twice the money for their .