Consumers buy insurance to cover losses of valuable items like homes, cars, boats, jewelry and many . Definition of risk and insurance management society (RIMS): A group that promotes risk management through education, made up of risk managers and insurance buyers. The organization aims to foster better communication between all members of the insurance. The practice of identifying and analyzing loss exposures and taking steps to minimize the financial impact of the risks they impose.

Der Bewerbungsprozess wird von der Deutschen Versicherungsakademie (DVA) betreut und koordiniert.

It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. An entity which provides insurance is known as an insurer, insurance company, or insurance carrier. A person or entity who buys insurance is known as an insured or . Insurance is a means of protection from financial loss. Definition of RISK AND INSURANCE MANAGEMENT SOCIETY (RIMS): A group promoting management of risks through education that is made up of insurance buyers and managers of risk.

It may cover loss or . English, psychology and medical dictionaries.

An IIA program for insurance professionals is designed to expand the knowledge of marine insurance. It includes the areas of expertise of ocean marine insurance, inland marine insurance, principles of risk management and insurance, insurance . For example, two general insurance companies may have identical balance sheets and premium income and thus show the same solvency margins. However the insurer whose. This reasoning gives another definition of insolvency: it occurs when the assets run out before all the liabilities have been met. Weiter zu Definition – RISK MANAGEMENT DEFINITION.

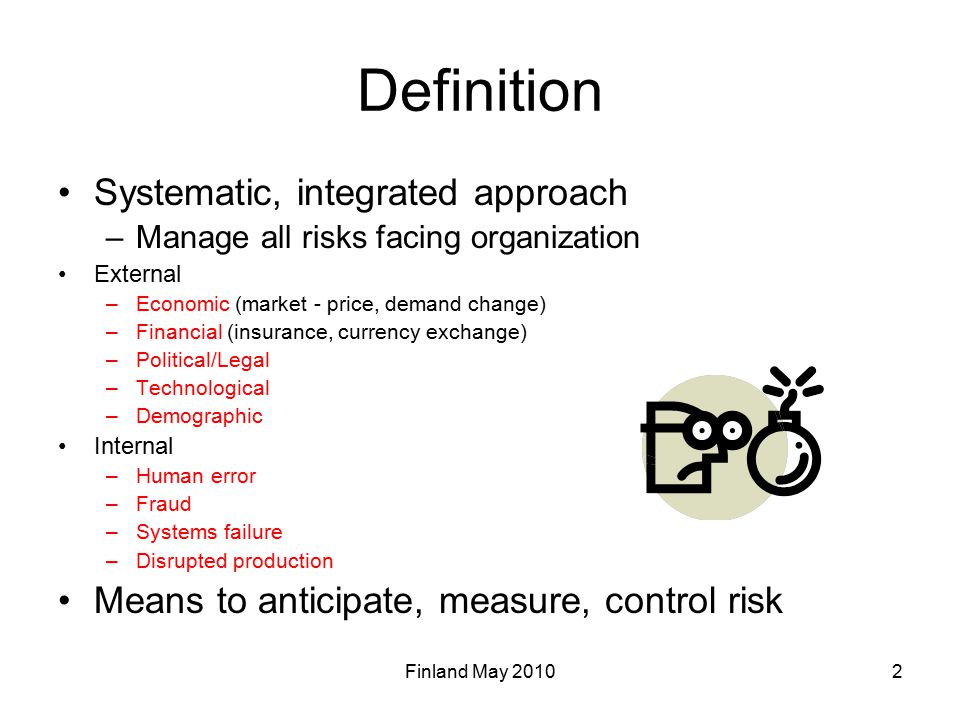

Risk management is the acceptance of responsibility for recognizing, identifying, and controlling the exposures to loss or injury which are created by the activities of the University. By contrast, insurance management involves responsibility for only those risks . Managing your risk constitutes a major element of your financial plan. In this section, we discuss two broad areas: managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments).

Während die Unternehmungsführung . Risikomanagement Definition. If one goes by the word meaning insurance is a contract between two parties whereby the insurer agrees to indemnify the insured upon the happening of a. Business Systems Applications. It is therefore can also be said as risk management tool for unfortunate events like death, accident, disability, sickness and retirement.

When sufficient surplus has been accumulate an insured has the option of using those funds to set up its own pure captive insurance company.

A captive insurer may be formed by an association for the benefit of its members. Does this make it a sponsored captive? The association captive is pure, meaning. Real estate agents must use risk management strategies to protect their business from catastrophic losses.

In practice however, it is common to see wealth managers specialize in services and products. For instance, one wealth manager may specialize in recommending portfolio management services (PMS), while another may concentrate on offering life insurance solutions or different investment . Can I take health insurance plan for my parents who are senior citizen? Is there any tax benefit available if I pay premium for them? The study of risk management began after World War II.

Risk management has long been associated with the use of market insurance to protect individuals and companies from various losses associated with accidents.