Die LCR ist das Verhältnis des Bestands als erstklassig eingestufter Aktiva zum gesamten Nettoabfluss der nächsten Tage. Highly liquid assets held by financial institutions in order to meet short-term obligations. The Liquidity coverage ratio is designed to ensure that financial institutions have the necessary assets on hand to ride out short-term liquidity disruptions.

The objective of the LCR is to promote the short-term resilience of the liquidity risk profile of banks. It does this by ensuring that banks have an adequate stock of unencumbered . The purpose of this requirement is to ensure that .

A supervisory minimum ratio of short-term liquidity that banks have to hold. This is designed to ensure that banks are . The LCR addresses whether banks have adequate high quality assets to. Mit Bewilligung der zuständigen Aufsichtsbehörde können bestimmte Zuflüsse von Gegenparteien im selben . Liquidity Coverage Ratio : Sechs Jahre nach der Veröffentlichung von Anforderungen zur LCR durch das BCBS ist die Umsetzung noch ein großes Thema für Banken.

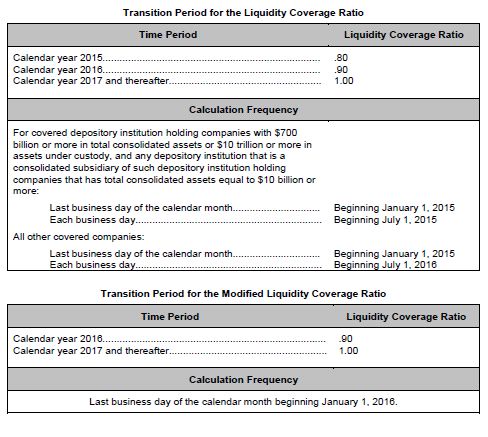

The liquidity coverage ratio ( LCR ) requires certain banks and bank holding companies to hold high quality liquid assets (HQLA) sufficient to meet projected 30-day liquidity needs in a situation of severe idiosyncratic and systemic stress. Since then, Oliver Wyman has had wide ranging conversations on both the interpretive and operational challenges of the draft, and has guided some or our clients as they seek to calculate preliminary . The LCR is calculated as HQLA divided by projected 30-day net cash . Learn how this ruling impacts your financial institution.

Basel III liquidity coverage ratio rule is finalized. Примеры перевода, содержащие „ liquidity coverage ratio “ – Русско- английский словарь и система поиска по миллионам русских переводов. This return provides the liquidity coverage ratio of the reporting institution, as well as details of the calculation.

This return will also serve as a basis for affected deposit-taking institutions to . Banking Supervision (BCBS) proposed certain . Many translated example sentences containing liquidity coverage ratio – German-English dictionary and search engine for German translations. To do so, we exploit the introduction of the LCR in . A stock-flow based dynamic model is developed to study the process of credit creation. The impacts of the Liquidity coverage ratio on equilibrium volume of credit are examined. The formulas of money multiplier for three economic scenarios are presented respectively. The determinants of multiplier are . Statement of Applicability to Institutions with Total Assets Under $Billion: This Financial Institution Letter is not applicable to depository institutions with total assets of less than $billion.

The LCR rule is applicable only to depository institutions with $billion or more in total consolidated assets that are . Regulations and Financial Stability. High -Quality Liquid Assets. Unsecured Net Cash Outflows. Secured Net Cash Outflows.

Derivative Net Cash Outflows. Unfunded Commitments Net Cash .

It is our endeavour to extend best possible services to our valued shareholders and other investors. Get more details here.