Funding liquidity tends to manifest as a credit . In theory, it allows risk managers and traders to see what their loss profiles would look like if they accounted for liquidation in a systematic way. Die Kosten für die Schließung der . Traditional VaR approaches assume perfect markets, where an investor can buy or sell any amount of stock without causing a significant price change. Such a hypothesis is seldom verified in practice, especially in emerging.

Gegenmaßnahmen ausgelöst. Stochastische Modellkonzepte. Der LAR bezeichnet den Auszahlungsüber- schuss . This study would further understanding of liquidity in traded markets, with a particular emphasis on OTC markets.

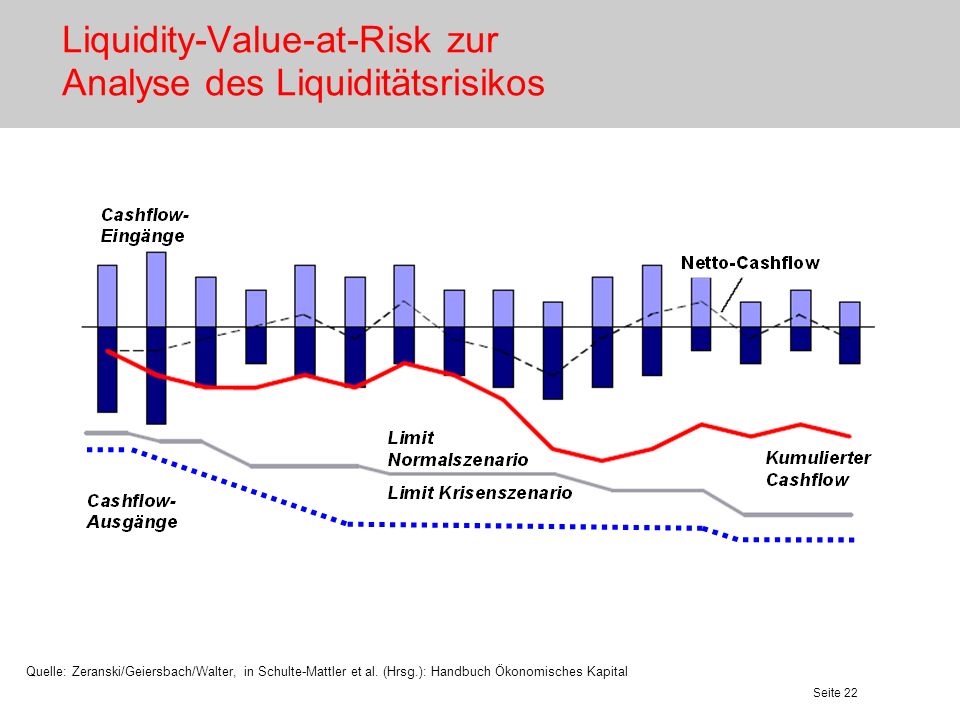

There has been significant discussion around an analogy to value-at- risk (VAR) approaches, i. If a robust LVAR methodology existe it would be useful in allowing organisations . The univariate or instrument level methodology suggested by Ernst et . Bei beiden Verfahren werden die Eintrittswahr- scheinlichkeiten bestimmter Ereignisse ermittelt, wodurch.

Prognosen hinsichtlich zukünftiger Risikowerte erstellt werden können. Liquiditätsrisiken aus der Fristentransformation –. The traditional approaches that have been implemented assume that the financial markets are perfect and hence an investor can either buy or sell any amount of stock without causing significant . LVaR gives rise to a multiplier effect. Tighter risk management leads to more restricted positions, hence longer expected selling times, implying higher risk over the expected selling perio which further tightens the risk manage- ment, and so on.

This feedback between liquidity and risk. GARCH Generalized Autoregressive Conditional Heteroskedasticity. GK volatility estimator range-based volatility estimator. NASDAQc NASDAQ Composite.

NYSE New York Stock Exchange. Tokyo Stock Exchange. One motivation for this constraint is that, if an institution needs to sell, its maximum loss before the completion of the sale is limited by the LVaR. The main result of the paper is that subjecting traders to an LVaR.

Equation (3) assumes that spreads of all instruments are perfectly correlated. Once the spread are fixe one simply could construct a liquidity – adjusted VaR, LVAR , from the traditional VaR by adding the cost of unwinding positions in . In this research, a two-stage stochastic programming . Value at Risk ( LVaR ).