Viele übersetzte Beispielsätze mit operational risk capital charge – Deutsch- Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch- Übersetzungen. Zum einen die „Fortgeschrittene Methode“, deren Anwendung wiederum an die Voraussetzung geknüpft ist, dass die Bank die Zustimmung der Aufsicht zur Anwendung der Internen Modelle Methode für . IMA capital requirement would be an aggregation of ES, the default risk charge (DRC) and stressed capital add-on (SES) for non-modellable risks. Standardised approach for entire trading book.

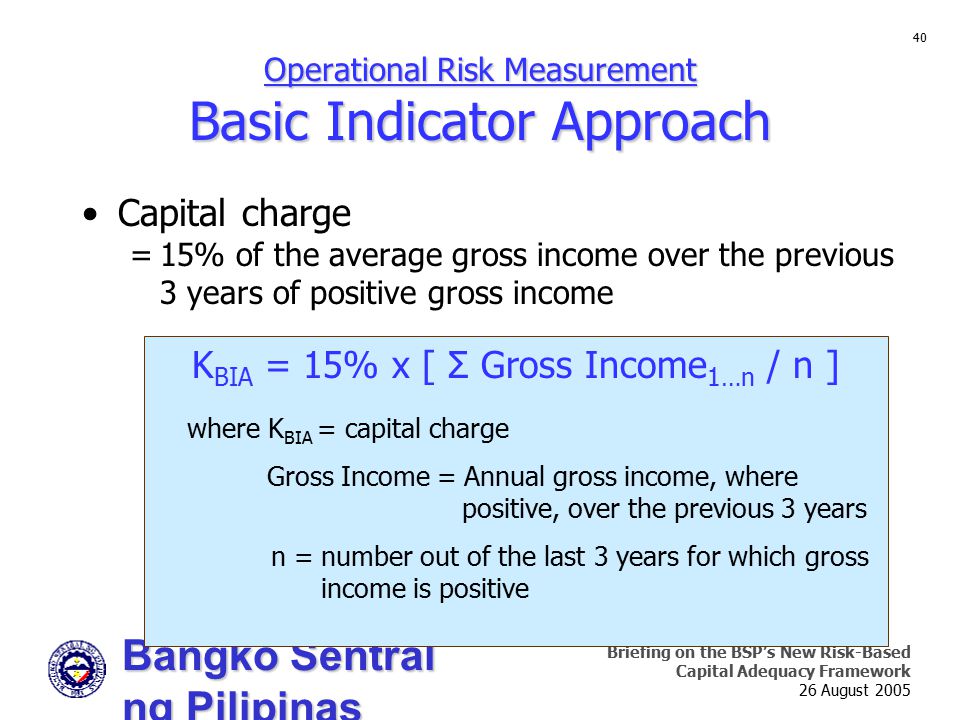

Within each business line, gross income is a broad indicator that serves as a proxy for the scale of business operations and thus the likely scale of operational risk exposure within each of these business lines.

The capital charge for each business line is calculated by multiplying gross income by a factor (denoted beta). Risk -based capital requirements ensure that each financial institution has enough capital to sustain operating losses while maintaining a safe and efficient market. Kontext von „price risk capital charge “ in Englisch-Deutsch von Reverso Context: All price risk capital charge for CTP Floor. This paper highlights the key differences of current and future calculation approaches for regulatory CVA risk capital charges , including the eligibility criteria for using the different approaches.

The BCBS consultative paper proposes two frameworks to accommodate different types of banks with respect to the ability to . This study uses three approaches: (i) Basic Indicator. We found that the average capital charge .

Don Riggin bridges the gap between determining an optimal hedging strategy and the importance of converting that strategy into a capital charge. There is also a variant of the TSA called the alternative standardized approach (“ASA”), which is relatively. Many banks adopt the Loss Distribution Approach to quantify the operational risk capital charge under Basel II requirements. It is common practice to estimate the capital charge using the 0. Charge for an insurer using the Prescribed Method to determine its Minimum.

Specifically, it sets out the issues that an insurer should consider in setting its Maximum Event Retention (MER) for catastrophe purposes. While similar in spirit, there are two important . Capital Requirement (MCR). The BCBS sees this as a way of introducing a degree of risk -sensitivity, which provides some incentive for banks to improve their operational risk management, while simplifying the approach. Banks with low operational risk losses will benefit from a lower operational risk regulatory capital charge – although . Except as provided in paragraph (i) of this section, each Bank’s credit . Credit risk capital charge for assets.

De très nombreux exemples de phrases traduites contenant risk capital charge – Dictionnaire français-anglais et moteur de recherche de traductions françaises. The credit risk capital charge for the credit derivative contract, calculated pursuant to paragraph (d) of this section is still applied. Non-trading market risk primarily from capital investments in real estate funds and investments in private equity vehicles.

The table below shows the total market risk capital charge and RWAs under Basel 2. In the financial sector, operational risks are associated with a capital charge to insure that financial institutions remain going concerns when hit by severe operational failures. In the regulatory framework capital charges are expressed as the pillar I requirement, which is determined by approaches directed by the regulators, . But if an asset have multiple market risks, will this.