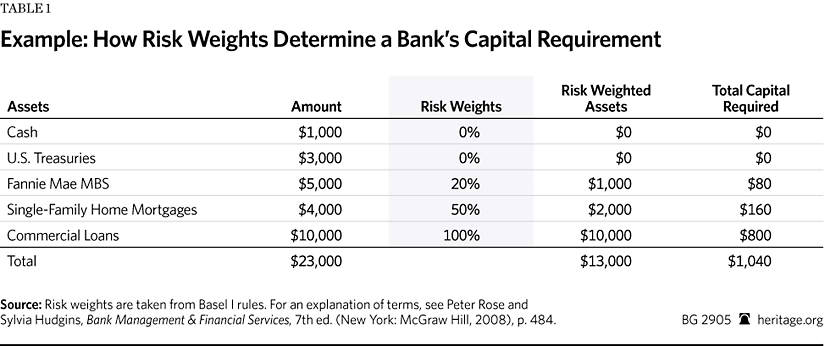

This sort of asset calculation is used in determining the capital requirement or Capital Adequacy Ratio (CAR) for a financial institution. In the Basel I accord published by the Basel Committee on Banking Supervision, the . In terms of the minimum amount of capital that is required within banks and other institutions, based on a percentage of the assets , weighted by risk. It calls for the calculation of.

These strategies, which mainly focus on the improvement of asset quality, imply the choice of those counterparties showing the lowest risk profile for a given level of return on investments. Assets, weighted by these components .

Many translated example sentences containing risk weighted assets calculation – German-English dictionary and search engine for German translations. Basel II provides what it calls a Standardized Approach to calculate RWAs. This weighting is based upon the credit rating of an asset type as a measure of its relative level of risk. The Basel II approach to risk – weighting MFI assets is summarized in the table below, by balance sheet asset type, off balance sheet elements, and . Calculation of minimum capital requirements. Part presents the calculation of the total minimum capital requirements for credit, market and operational risk.

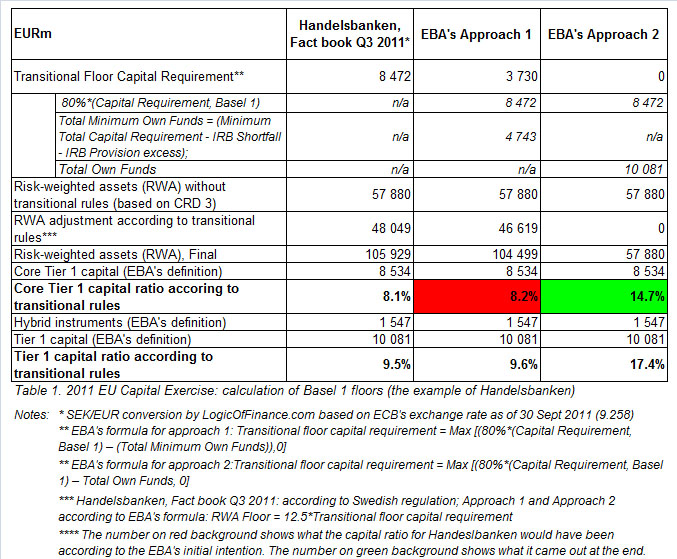

The capital ratio is calculated using the definition of regulatory capital and risk – weighted assets. The total capital ratio must be no lower than.

Regulators then use the risk weighted total to calculate how much loss-absorbing capital a bank needs to sustain it through difficult markets. The main use of risk weighted assets is to calculate tier and tier capital adequacy ratios. Under the Basel III rules, banks must.

Low risk assets are multiplied by a low number, high risk assets by 1 (i.e. 1). Suppose a bank has the following assets: . Common Equity Tier Capital. In addition, a banking institution carrying on Skim Perbankan Islam. The second most important technical parameter used in banking regulations is risk – weighted assets (or RWA ). Credit Scoring models often become inputs into regulatory and economic capital calculations such as the Basel RWA formula.

Probability of Default (PD), Exposure at Default (EAD) and Loss given default (LGD) models are all used for this purpose. One measure of loss, Expected Loss, is simply given by . It is the role of the ECB, among others, to maintain risk sensitivity and the incentives for internal modelling. Risk-weighted asset ( RWA ) calculations for credit.

Applicability to banks of all sizes—large or small. Market and operational risks. While the standardized approach of Basel III introduces a more risk-sensitive treatment for various exposure categories than that of Basel II, the advanced approaches add. DIRECTORATE-GENERAL FOR INTERNAL POLICIES.

ECONOMIC GOVERNANCE SUPPORT UNIT.

External authors: Bennet Berger. Measuring credit exposures requires adjustments to be made to the amount of assets shown on a.