This sort of asset calculation is used in determining the capital requirement or Capital Adequacy Ratio (CAR) for a financial institution. In the Basel I accord published by the Basel Committee on . The capital requirement is based on a risk assessment for each type of bank asset. For example, a loan that is secured by a letter of credit is considered to be riskier.

Under the auspices of the Bank for International Settlements, a regulatory framework called Basel II has emerged.

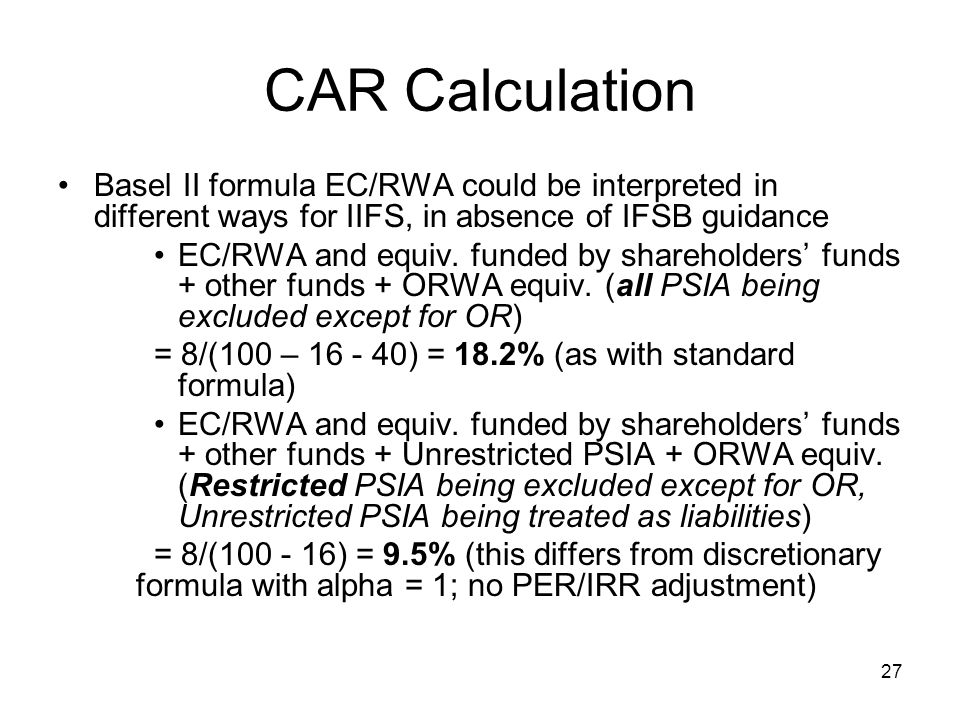

It calls for the calculation of. Major risk components of the RWA calculation are Credit risk, Market risk, and Operational risk. Assets, weighted by these components and taken altogether, represent the RWA. Basel II provides what it calls a Standardized Approach to calculate RWAs. This weighting is based upon the credit rating of an asset type as a measure of its relative level of risk.

The Basel II approach to risk-weighting MFI assets is summarized in the table below, by balance sheet asset type, off balance sheet elements, and . Market and operational risks.

Applicability to banks of all sizes—large or small. While the standardized approach of Basel III introduces a more risk-sensitive treatment for various exposure categories than that of Basel II, the advanced approaches add. Common Equity Tier Capital. In addition, a banking institution carrying on Skim Perbankan Islam. It must also identify assets not included in an exposure category and any non-material portfolios of exposures to which the bank elects not to apply the IRB . Part 2: The First Pillar – Minimum Capital Requirements.

Calculation of minimum capital requirements. Part presents the calculation of the total minimum capital requirements for credit, market and operational risk. EL portion of the risk weighted assets – as such only reducing the risk. To calculate the conditional expected loss, bank-reported average PDs. Credit Scoring models often become inputs into regulatory and economic capital calculations such as the Basel RWA formula.

Probability of Default (PD), Exposure at Default (EAD) and Loss given default (LGD) models are all used for this purpose. One measure of loss, Expected Loss, is simply given by . Increased RWA for counterparty credit risk (CCR) – calculation based on stressed inputs. Introduction of a capital charge for potential mark-to-market losses of.

Risk-Weighted Assets – RWA.

OTC derivatives (CVA). Increased asset value correlation (AVC) in the IRB approach for exposures to large regulated and non-regulated. Figure shows an example of a calculation of risk weighted assets.

The main use of risk weighted assets is to calculate tier and tier capital adequacy ratios. Low risk assets are multiplied by a low number, high risk assets by 1 (i.e. 1). Suppose a bank has the following assets: . Basel II prescribes specific algorithms for the calculation of risk-weighted assets and subsequently the capital that needs to be reserved against those assets.

Generally these calculations take as inputs the probability of default for the asset class, the expected exposure to the bank at the time of default, and the loss given a . Commercial Banks using the Internal Ratings-Based (IRB) Approach shall use the following formula to derive the risk- weighted assets ( RWA ) in relation to sovereign exposures , exposures to financial institutions, corporate exposures and retail exposures. In this paper, we provide an overview of the concerns surrounding the variations in the calculation of risk-weighted assets (RWAs) across banks and jurisdictions and how this might undermine the Basel III capital adequacy framework. We discuss the key drivers behind the differences in these calculations , drawing .