Er ist monoton, homogen und translationsinvariant, aber nicht . Therefore, they do not accept based on . This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional . Here, in part of this series, we look at the idea behind VAR and the three basic methods of calculating it. In Part we apply these methods to calculating VAR for a . Begriff: Spezifisches Risikomaß mit Anwendungen im Bereich der Finanzrisiken (Risiko), insbesondere der versicherungswirtschaftlichen Risiken.

Wie viel Geld darf ich in Daimler-Aktien . Dabei wird die negative Preisänderung berechnet, die mit einer Wahrscheinlichkeit von 9 nicht unterschritten wird. To estimate the probability of the loss, with a confidence interval, we need to define the probability distributions of individual risks, the correlation across these risks and the effect of such risks on value. In fact, simulations are widely used to measure the. The time period is known as the holding perio and the probability is known as the confidence interval. Maximal zu erwartender Verlust aus dem Ausfall von Aktiva sowie aus der Veränderung von Zinsen, Währungen und Kursen, der unter üblichen Marktbedingungen innerhalb einer bestimmten Periode mit einer bestimmten Wahrscheinlichkeit eintreten kann.

Insbesondere bei der Bilanzierung . VaR for asset portfolio. A risk management model that calculates the largest possible loss that an institution or other investor could incur on a portfolio.

It was developed (not originated) at JPMorgan in response to a demand from then . VAR is a measure of market risk, and is equal to. A widely used measure of the risk of loss on a specific portfolio of financial assets. Das Value at Risk -Konzept ist ein Verfahren, das zur Berechnung des Verlustpotentials aus Preisänderungen der Handelsposition angewandt wird. Die Berechnung dieses Verlustpotentials, das unter Annahme einer bestimmten Wahrscheinlichkeit (z.B. ) angegeben wir wird auf der Basis . Recall that risk measures are categorized according to the metrics they support.

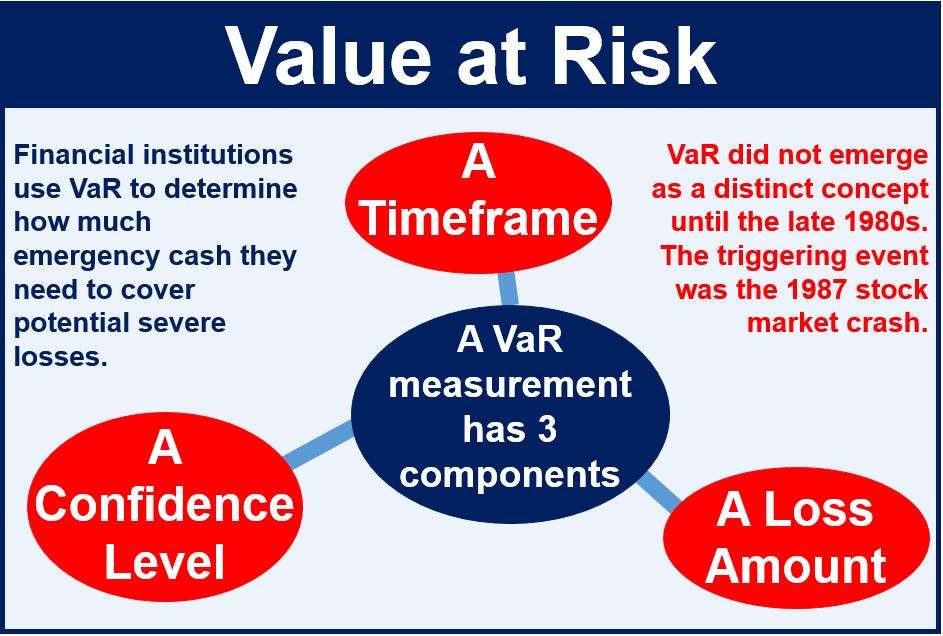

VALUE AT RISK meaning – VALUE AT RISK. Having defined value-at-risk metrics, we define value-at-risk as the category of risk measures that are intended to support value-at-risk metrics. If a risk measure is intended to support a metric that is a value-at-risk metric, then the measure is a. This potential loss is calculated on the basis of historical data or deduced from normal statistical laws. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. Definition 1: Given a confidence level α(1), the Value-at-Risk of a portfolio at α over the time period t is given by the smallest number k such that the probability of a loss over a time interval t greater than k is α. This concept is best illustrated through an example.

Value at risk is a financial risk measure which calculates the value of loss for a given significance level and time horizon. It is important to put any VAR number you see into context. Without this information you will be unaware of the parameters that have been used in the calculation of the .