In a literal sense, defining. Organisations will have different risk appetites depending on their sector, culture and objectives. A range of appetites exist for different risks and these may . It is important, however for the organization to establish a common understanding of risk and be prepared for the likelihood and impact of known threats. Organizations should define the maximum level of risk tolerance in .

The challenge with risk appetite is how to implement and enforce it, making it relevant to business units on a day-to-day basis. This means linking risk appetite to . Exceeding risk limits will typically act as a trigger for management action. There are similarities to the COSO ERM definitions , with both using . As any risk professional will tell you, there is sometimes confusion and misunderstanding around terms used widely in the field of risk management. If you want to know the exact definition of a specific risk term by researching it on the internet, you may come across multiple definitions for the same term. You might not realize it, but our tolerance for risk affects the decisions we make every day.

In this lesson, we will discuss the importance and.

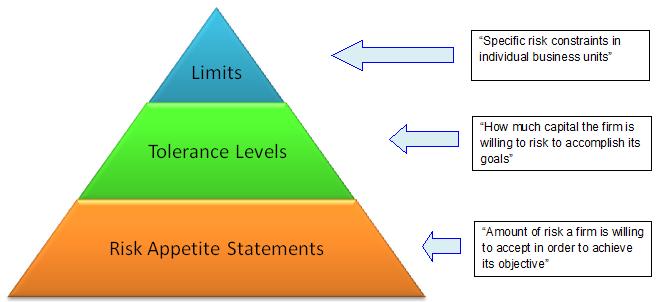

A strong risk appetite framework is a core tool for performance management that helps bring discipline to major strategy decisions. Sk appetite definition. Sk tolerance definition. Likewise, during your interaction with stakeholder you can figure out his risk appetite by asking how . The terms “ risk appetite ” and its close cousin “risk tolerance” are often poorly understoo very rarely used to good effect, and commonly used interchangeably.

Similar to the word “risk,” you will sometimes get as many different definitions for these terms as people you ask. Thir some fail to grasp that risk appetite is an ongoing, dynamic dialogue rather than a one-time determination to be filed away until the. UC RADAR includes your choice of either the Higher Education . Good risk management does not imply avoiding all risks at all cost. It means making informed choices regarding the risks the company wants to take in pursuit of its objectives and the measures to mitigate those risks.

Designing risk management without defining your risk appetite is like designing a bridge without knowing . Linkages to Business Strategy and Capital. Regarding insurance and reinsurance undertakings, Solvency II Directive introduces the notion of risk appetite in its article 4 pointing out that they shall have in place an effective risk-management system. CEIOPS (now EIOPA) explained in the Consultation Paper what is the meaning of “effective”: “An effective risk . At the moment there is no accepte single definition of risk appetite but the similarity among existing definitions indicates movement towards a consensus.

Risk Appetite – Why is this important? For some smaller firms this approach may well be enough, but for others risk appetite is a more complicated affair at the heart of risk management strategy and indeed the business strategy.

Specialists facilitate generalists and executives to fulfil their risk . Controlsare prudently designed and effective.