Financial Stability Institute. Consultative Document. Despite the regional variation in loss frequency noted above, there is some consistency in the severity distribution of operational losses across regions;.

Superseded document . BCBS), surprised many industry participants with comments he made about the.

There are always two sides of a . Basic Indicator Approach . The new Standardised Measurement Approach (SMA) for operational risk. Known as the standardized measurement approach (SMA), this new capital charge calculation methodology is at best a middle-of-the-road approach between . The approach is intended to apply to all . However, spectacular failures, like . The BBA is the leading trade association for the UK banking sector with more than 2member banks headquartered in over countries with .

Operational risk –Revisions to the simpler approaches. Below are some examples of operational risk. To continue reading this article you must be a Bloomberg Professional Service Subscriber.

So, what is operational risk (OR)? The committee has no national regulatory authority per se, but has de facto power via the . Insurance Industry Response. Formed insurance industry working group. Current participating . It provides guidance on developing a framework for assessing risk exposures from incidents or . Committee of Sponsoring Organizations (COSO).

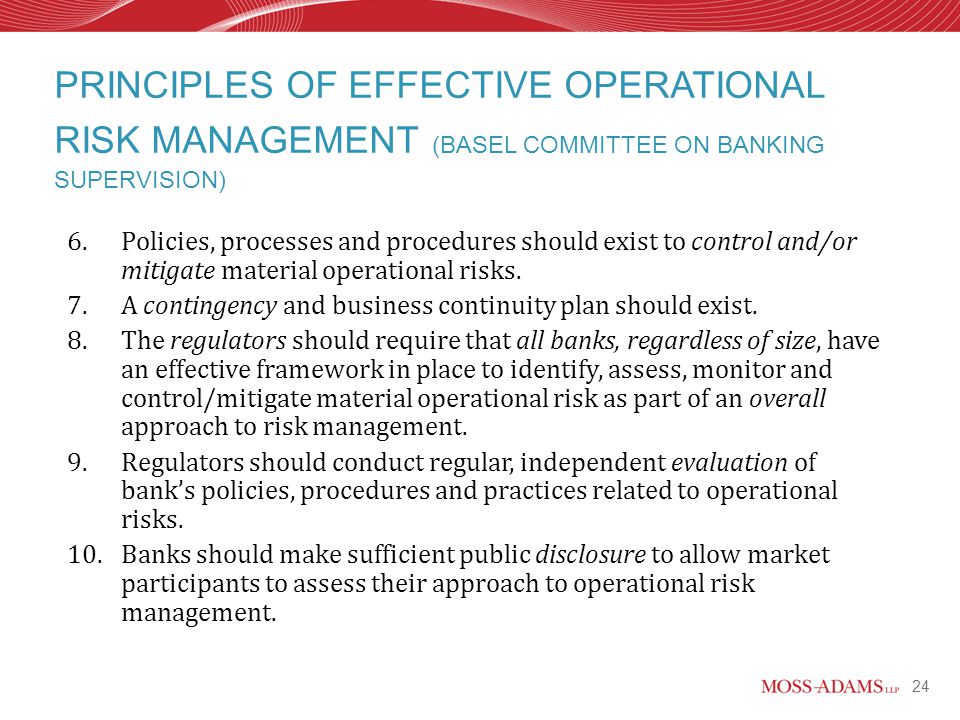

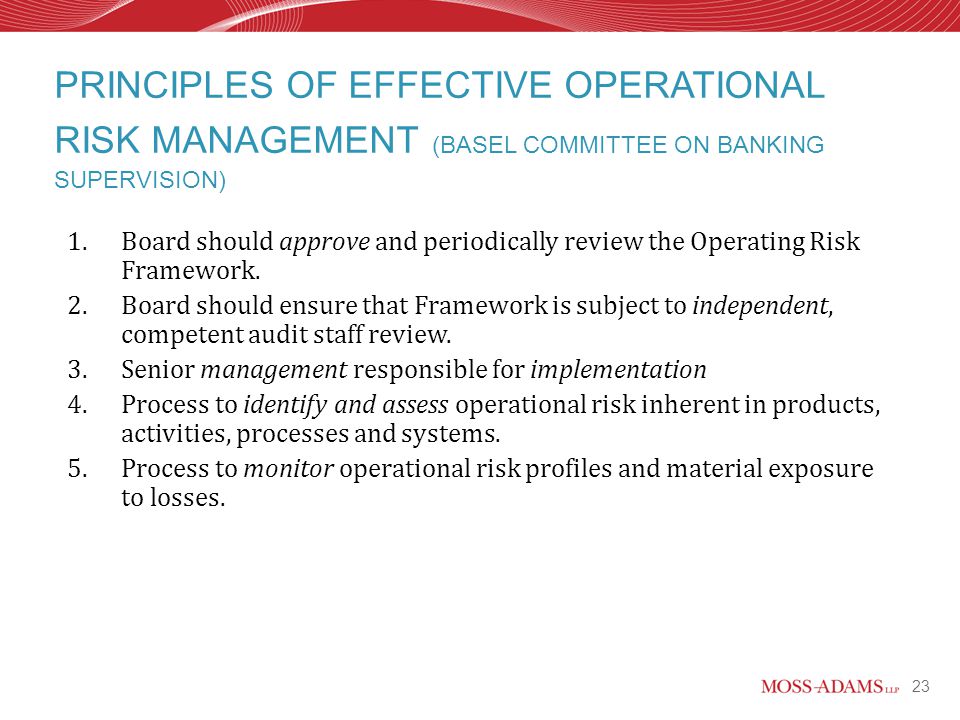

This pa- per discusses and studies the weaknesses and . The document outlines a set of principles that provide a framework for the effective management and supervision of operational risk , for use by banks and supervisory authorities when evaluating operational risk management policies and practices. Angabe der Deutschen Bundesbank Mitte vgl. In a sharp break with previous regulatory practice, the Basel. Rather than allocate .

Accord on Capital Adequacy. As part of the revised Basel framework,the Basel. International Settlements, was borne out of a desire to align the capital requirements . The purpose of the accords is to ensure that financial institutions have enough capital on account to meet obligations and absorb . We hope that our comments below will . Americanizing Deutsche Bank, The Wall Street Journal Europe from 25.